Financial Aid

AIE is fully approved to receive Title IV funding from the U.S. Department of Education ( www.ed.gov ). This approval means that we are able to accept the Free Application for Federal Student Aid (FAFSA) at both our Seattle and Lafayette campuses.

How Financial Aid Works

Financial aid is essential to most students planning to attend college. Find out more about how financial aid works here: https://studentaid.gov/h/understand-aid/how-aid-works

Apply for Financial Aid

Completing the FAFSA form is free. The link to complete the form is: https://studentaid.gov/fafsa-app/ROLES

Parent PLUS loan

PLUS loans can help pay for education expenses not covered by other financial aid: https://studentaid.gov/understand-aid/types/loans/plus/parent

Federal student aid includes:

- Grants — Most types of grants, unlike loans, are sources of financial aid that generally do not have to be repaid.

- Scholarships - Scholarships are gifts. They don't need to be repaid. There are thousands of them, offered by schools, employers, individuals, private companies, nonprofits, communities, religious groups, and professional and social organizations.

- Loans — Borrowed money for college or career school; you must repay your loans, with interest

VA Educational Benefits:

GI Bill® - Education Programs offered to veterans, service members and their dependents.

Important information:

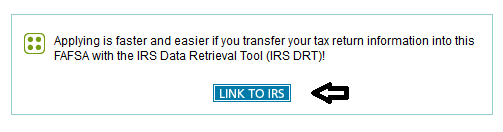

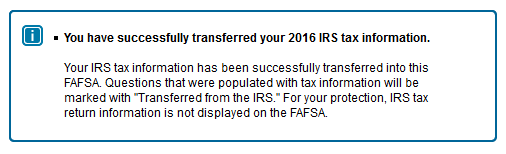

- Submit your FAFSA at https://studentaid.gov/h/apply-for-aid/fafsa

- AIE Seattle’s school code for FAFSA is 042236.

- AIE Lafayette’s school code for FAFSA is 042484.

- We recommend completing the FAFSA as soon as possible, as some funds are awarded on a first-come-first-served basis.

- If you intend on taking on Student Loans, please submit a Master Promissory Note and complete Entrance Loan Counseling.

- You may be required to fill out additional forms for AIE. We will notify you if this is the case.

- Feel free to contact us at finaid@aie.edu.au if you have any questions!

AIE Scholarships

AIE offers scholarship opportunities for students on the basis of academic merit and financial need. See our Scholarship page for more information.

Other Scholarships

Many organizations offer scholarships or grants to help students pay for college. This free money can make a real difference in how affordable your education is. (Check with Chambers of Commerce of your City, Kiwanis Club, Lion's Club, Heritage Societies such as Son's of Norway, Italian American Society, Snohomish Education Foundation, La Conner Community Scholarship Foundation, Pride Foundation, Horatio Algier, Dollars for Scholars scholarship, etc).

Sallie Mae have a scholarship search on their website: Scholly® Scholarships by SallieSM

Sallie Mae Loans

AIE students can apply for a student loan for Career Training from Sallie Mae® here: salliemae.com/student-loans

Related Information

|

|